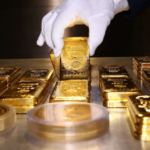

The gold market has witnessed significant activity in 2025, with prices reaching unprecedented levels. As of April 24, 2025, gold remains a focal point for investors seeking stability amid economic fluctuations. This article provides an in-depth analysis of the current gold bar market, examining recent trends, influencing factors, and future projections.

Current Market Overview

On April 24, 2025, gold prices experienced a modest increase, with the spot price reaching $3,338.11 per ounce . This uptick follows a period of volatility, where prices peaked at $3,500.05 per ounce earlier in the week .

In Indonesia, the price of 24-karat gold bars (Antam) is reported at 1,969,000 IDR per gram, marking a decrease from the previous day’s price . This decline suggests a market correction after a significant upward trend.

Influencing Factors

Several elements have influenced the recent movements in gold prices:

- Economic Policies and Trade Relations: Statements from political leaders, such as President Trump’s comments on the Federal Reserve and trade relations with China, have impacted investor sentiment. These developments have contributed to fluctuations in gold prices .

- Market Corrections: After reaching record highs, gold prices have undergone corrections. Analysts note that the sharp reversal from the $3,500 peak has raised the risk of a deeper correction in the short term .

- Investor Behavior: The recent dip in gold prices prompted investors to buy the dip, leading to a rebound in prices on April 24 .

- Central Bank Activities: Central banks continue to play a significant role in the gold market. The Swiss National Bank’s Q1 2025 profit was largely driven by gains in gold valuations .

Regional Price Variations

Gold prices differ across regions due to local economic conditions and policies. In Saudi Arabia, the 24-karat gold rate was 4,806 SAR per tola on April 24 . In Pakistan, the gold rate stood at Rs352,000 per tola for 24-carat gold .

Future Projections

Analysts maintain a positive outlook for gold. JP Morgan anticipates that gold prices could surpass $4,000 per ounce by Q2 2026, citing factors like increased recession probabilities and sustained investor demand .

Conclusion

The gold bar market on April 24, 2025, reflects a dynamic interplay of economic policies, investor behavior, and global events. While recent corrections have introduced volatility, the long-term outlook for gold remains strong