Dubai, UAE – June 2025 – Genor DMCC continues to solidify its position as a trusted gold bullion trading partner amid significant changes in the global economic landscape. With gold prices consistently hovering near all-time highs and increasing regulatory scrutiny across markets, Genor is adapting with a renewed focus on compliance, innovation, and strategic partnerships.

Gold Market Momentum in 2025

The first half of 2025 has seen gold bullion prices fluctuate between USD 2,200 and USD 2,400 per ounce, fueled by geopolitical tensions, continued inflationary pressure in Western economies, and shifts in central bank policies. Notably, increased demand from institutional investors and central banks—especially across Asia and the Middle East—has placed upward pressure on bullion demand.

Genor DMCC has responded by reinforcing its bullion trading operations with improved hedging strategies, more frequent client reporting, and stricter internal audit controls. “Our clients want transparency, compliance, and security. We are proud to say we are delivering on all fronts,” said a spokesperson for Genor.

Strengthening Compliance and Regulatory Alignment

In May 2025, the UAE announced new guidelines under the Ministerial Decision No. 34/2025 related to Responsible Sourcing and Anti-Money Laundering (AML) measures for precious metals trading companies. Genor DMCC was among the first in the Dubai Multi Commodities Centre (DMCC) to align with the updated regulations.

Genor’s compliance team, working closely with legal and audit advisors, implemented a revised Know-Your-Customer (KYC) and Due Diligence Protocol for all counterparties. This includes enhanced traceability for gold sources, especially those imported from high-risk jurisdictions.

“We view compliance not as an obstacle, but as a competitive advantage. Genor’s commitment to AML and ESG standards distinguishes us from many traditional bullion traders,” noted the head of Compliance at Genor.

Technology-Driven Transformation

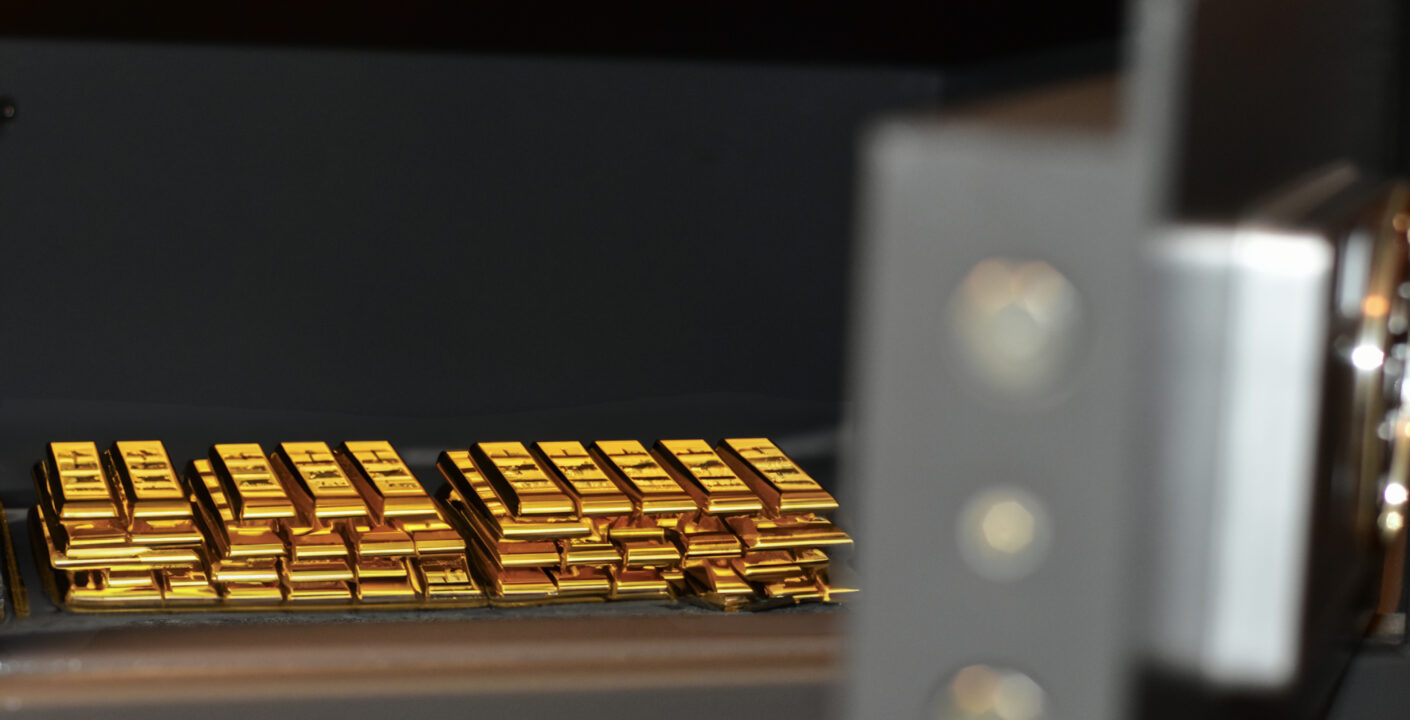

To stay ahead of the curve, Genor has adopted blockchain-based traceability tools and integrated them with its trade operations. Every gold bar that enters Genor’s inventory is now linked to a secure digital certificate containing information about origin, refinery, and logistical movements.

This real-time visibility ensures that both clients and regulators can verify the source and handling of gold traded through Genor. The platform also enhances trade settlement speed, reducing friction for counterparties in Asia, Europe, and Africa.

Expanding Trade Networks

The company is expanding its reach across the Middle East, Africa, and Southeast Asia. Recently, Genor has established trade corridors with partners in Ghana, Uzbekistan, and Malaysia, facilitating access to newly tapped gold sources and refineries.

In April 2025, Genor signed a Memorandum of Understanding (MoU) with a government-approved refinery in Central Africa, helping secure long-term supply while promoting ethical mining and community development.

“Our vision extends beyond trade. We are helping build ethical supply chains that benefit all stakeholders—miners, traders, and investors alike,” said Genor’s Trade Director.

Looking Ahead

As gold continues to serve as a hedge against volatility and inflation, Genor’s strategic evolution positions it for long-term success. The company is eyeing new digital platforms, artificial intelligence in compliance vetting, and further expansion in Asia-Pacific markets.

“Our roadmap for 2025-2026 includes integrating tokenized gold solutions and possibly launching a client-facing app for instant trade quotes,” revealed a Genor senior executive.

With a firm foundation built on trust, transparency, and technology, Genor DMCC is not just adapting to changes in the gold bullion industry—it’s leading them.